Do you qualify for

Tax Credits or Housing benefit

Here are some quick links to various UK Government

calculators which you can use, to help you establish if you qualify

for any benefits.

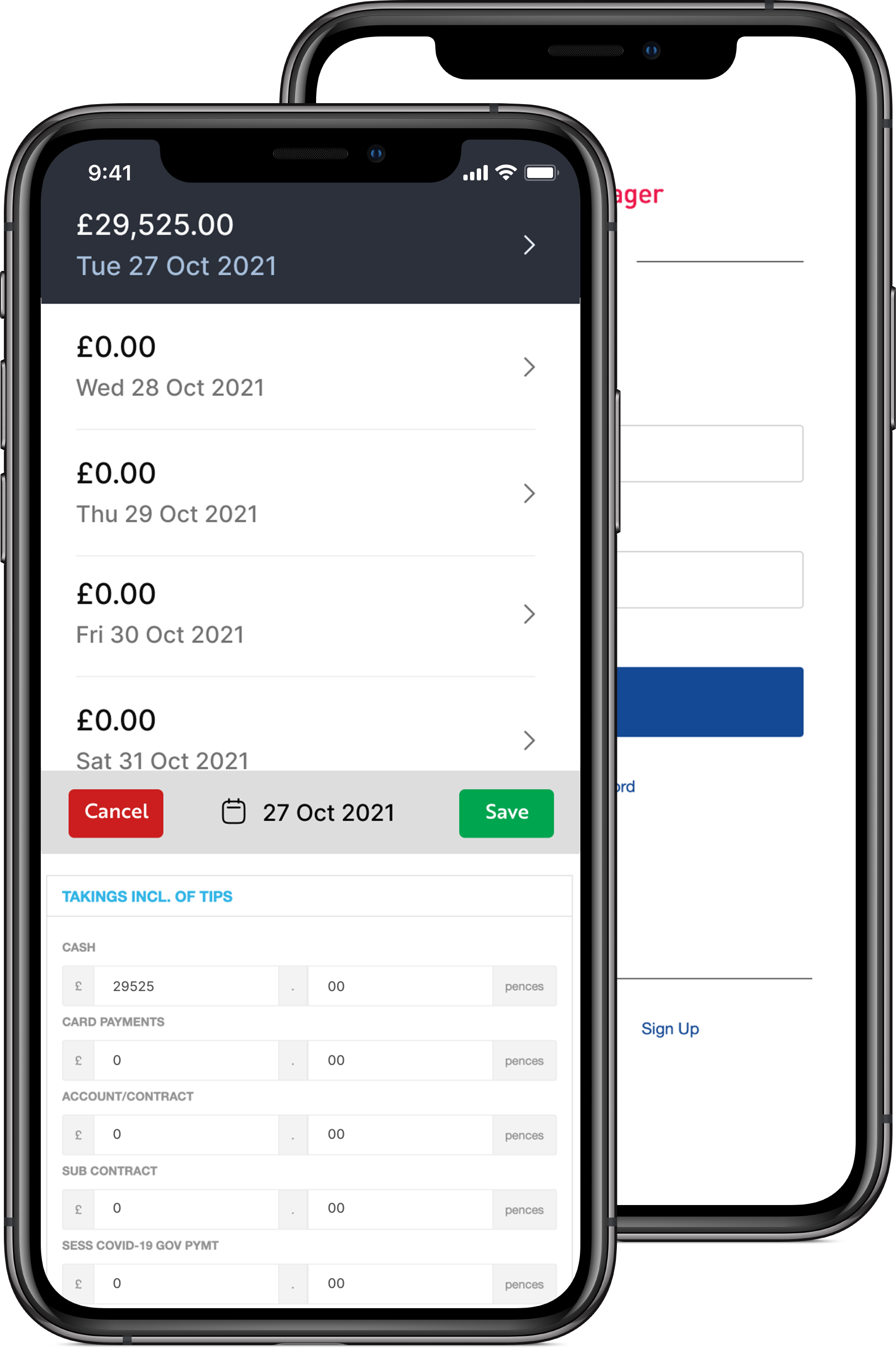

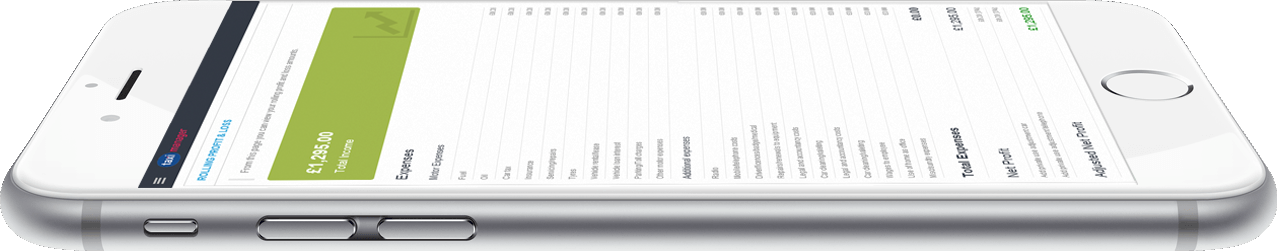

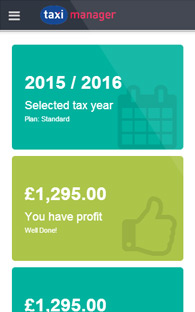

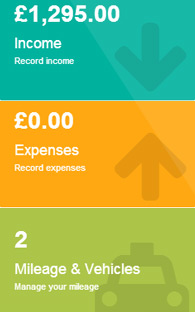

Please note when you are self employed, the income figure

that generally is requested, is the 'profit' figure. This is the

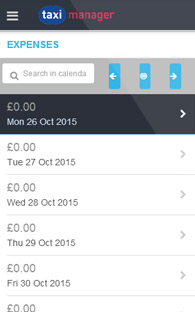

amount left over after you have deducted all allowable business (not

private) expenses from your takings, to arrive at a profit.

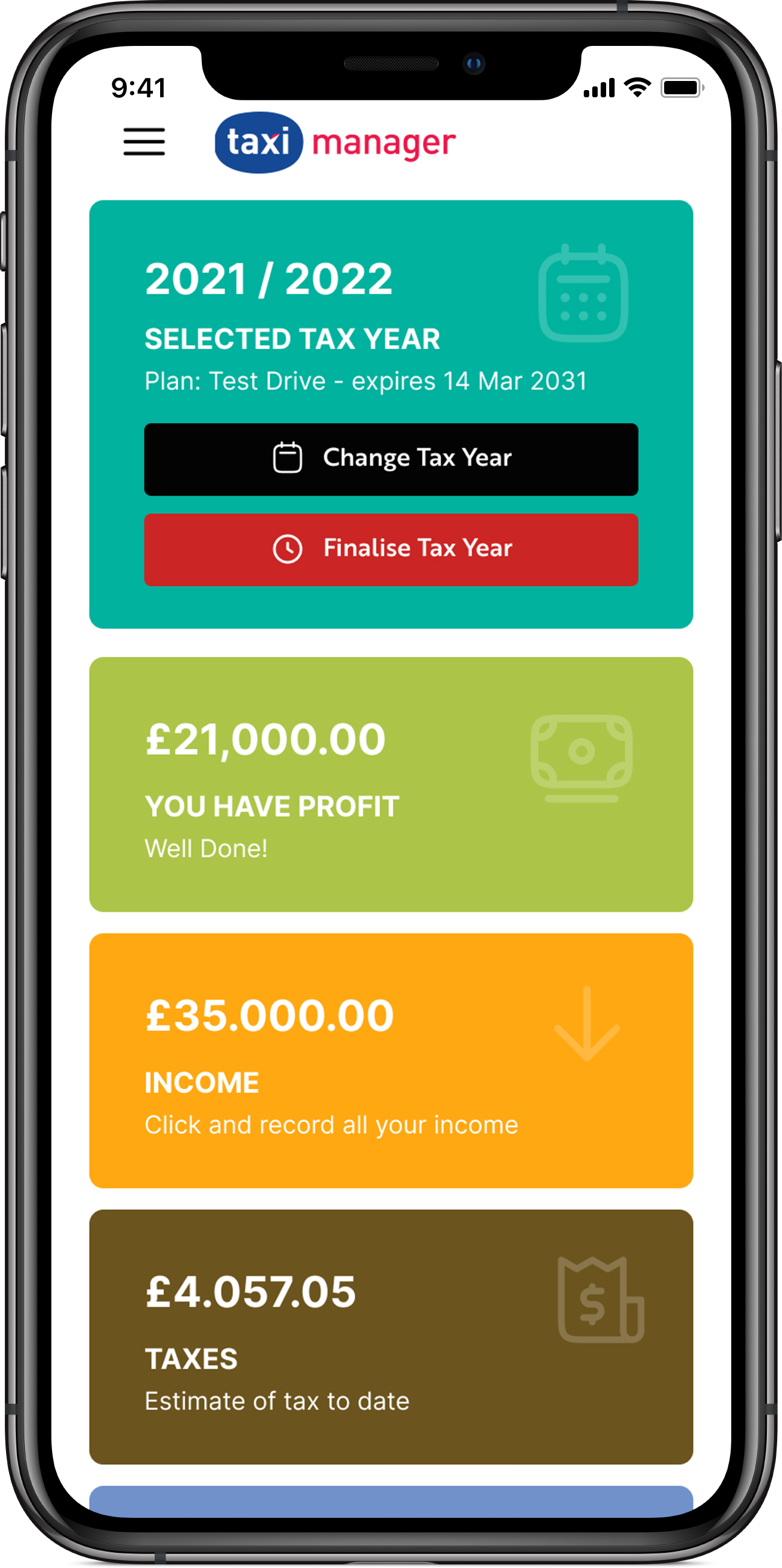

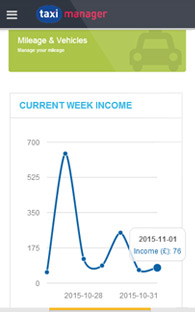

Taximanager works out this figure throughout the year

enabling you to use this figure so you can update

the relevant department, if you are making a claim(s).

Please note the Government does not have any access to your information

as this remains secure and confidential.

Useful links

https://www.gov.uk/tax-credits-calculator

http://taxcredits.hmrc.gov.uk/Qualify/DIQHousehold.aspx

https://www.gov.uk/housing-benefit